Roth Ira Last Day To Contribute 2025. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're.

Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older.

For tax year 2025, single filers and heads of household with a magi between $146,000 and $161,000 can only contribute a reduced amount.

What is a Roth IRA? The Fancy Accountant, Roth ira and ira contribution deadlines 2025. The same combined contribution limit applies to all of your roth and traditional iras.

Why Most Pharmacists Should Do a Backdoor Roth IRA, There’s no penalty for converting to a roth ira. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Does a Roth IRA Account Make Sense for You? Gorfine, Schiller & Gardyn, The same combined contribution limit applies to all of your roth and traditional iras. For tax year 2025, single filers and heads of household with a magi between $146,000 and $161,000 can only contribute a reduced amount.

Roth IRA Who Can Contribute? The TurboTax Blog, If you're a single filer and your modified adjusted gross income (magi) is less than $138,000, you can contribute the full amount to a roth ira for 2025. Be aware of the income limits associated with iras and.

The IRS announced its Roth IRA limits for 2025 Personal, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year is $6,500. Limits on roth ira contributions based on modified agi.

How Much Can I Contribute To Roth Ira 2025 Jenni Leanna, You can make 2025 ira. This deadline expires when 2025 taxes are due on april 15, 2025.

Is a savings account worth it anymore? Leia aqui Do you actually lose, Limits on roth ira contributions based on modified agi. For tax year 2025, single filers and heads of household with a magi between $146,000 and $161,000 can only contribute a reduced amount.

IRA Contribution Deadline Last Day to Contribute to Roth IRA (2025/, This deadline expires when 2025 taxes are due on april 15, 2025. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

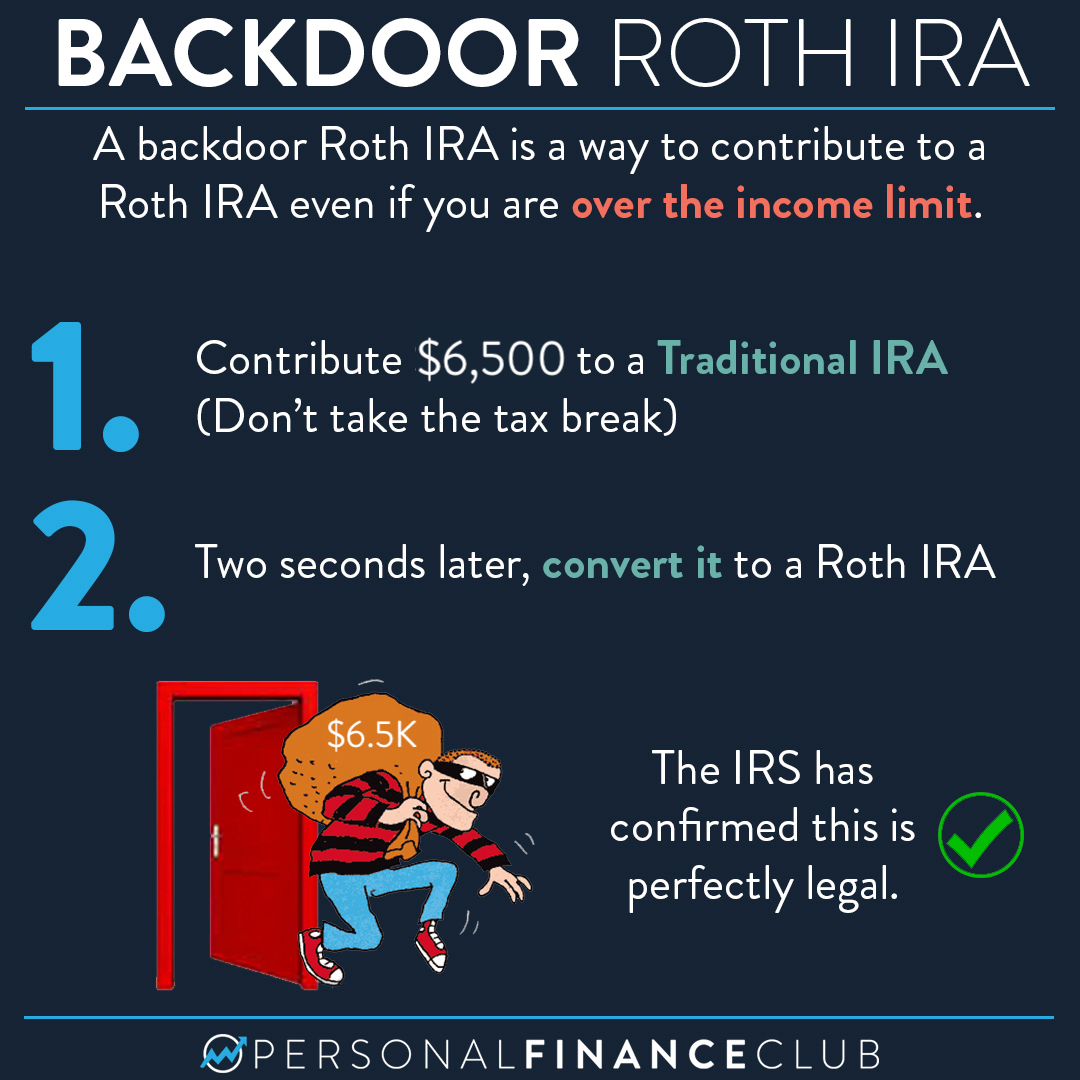

How does a Backdoor Roth IRA work? (2025) Personal Finance Club, For 2025 that increased to. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year is $6,500.

Can I still contribute to my Roth IRA in 2025?, There’s no penalty for converting to a roth ira. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025.